Important tool updates - Learn more

- Learn

-

Articles

Read about influencer marketing

-

Growthnotes - Newsletter

Insights for the modern marketer

The auto industry is facing a pivotal year. With 95% of vehicle buyers turning to digital sources for information, you can no longer rely on traditional touchpoints to influence decisions. At the same time, EV adoption is slowing, and trust in automakers has dropped to record lows.

AI is also rewriting how people search and how you prove marketing ROI. With ad budgets staying flat, you must do more with less while defending results. The truth is, your next moves will decide if you gain or lose ground.

In this article, you’ll learn about the key automotive marketing trends shaping 2025 and how they impact your strategy and results.

Let’s begin with how automotive marketing itself has shifted.

Digital-first dominance: 95% of buyers start online, with 43% of dealers now offering fully digital car purchases.

Flat budgets: Ad spend growth is projected at only 0.1% in 2025, making ROI proof critical.

EV slowdown: Only 34% of buyers plan to choose electric, shifting messaging toward cost, safety, and convenience.

Falling trust: Automakers face historic lows in public confidence, putting transparency at the forefront.

AI disruption: Zero-click search, AI-generated summaries, and predictive analytics are reshaping discovery and engagement.

Top 10 trends shaping strategies:

Key takeaway: Success in 2025 comes from personalization, authenticity, AI adoption, and measurable connections between national branding and local dealership outcomes.

Automotive marketing is the practice of promoting vehicles and related services through digital and traditional channels. This type of marketing guides buyers from research to purchase.

Marketing in the automotive world has changed from showroom-first strategies to digital-first strategies, where almost every decision starts online.

Cox Automotive reports that 43% of dealers now let buyers complete every step of a purchase online, up from 34% in 2022 and 39% in 2023. This shift signals how fast your retail model is adapting to buyer demand for speed and transparency.

You’re now competing on digital platforms, social commerce, and local search as much as on product features. That’s why digital showrooms, location performance optimization, and social media campaigns are core to guiding the consumer journey.

Next, let's see why these changes add new pressure in 2025.

Marketing leaders like you face tighter conditions than in past years. Growth is slowing, costs remain high, and buyers expect more value from every interaction.

The main forces shaping those challenges are:

You can also check out this YouTube video if you want to see why the car market might collapse:

The real question is how you adapt. So, let's discuss the benefits of adjusting early.

Staying ahead of disruption means protecting your growth, credibility, and long-term positioning. The key benefits you can gain by adapting to new trends in 2025 are:

If you understand these advantages, you can see why adaptation is less about survival and more about seizing growth opportunities. In the next section, we'll look at the specific marketing trends that will shape your priorities in 2025.

With new pressures reshaping your marketing mix, you need fresh approaches. These are the trends shaping the industry this year, along with their direct impact on your strategy and ROI.

Car buying has moved far beyond showroom floors, and social media is now influencing high-value decisions. Adtaxi 2024 Automotive Survey shows that 45% of Americans are open to buying a vehicle directly through these channels, with the number climbing even higher among recent buyers.

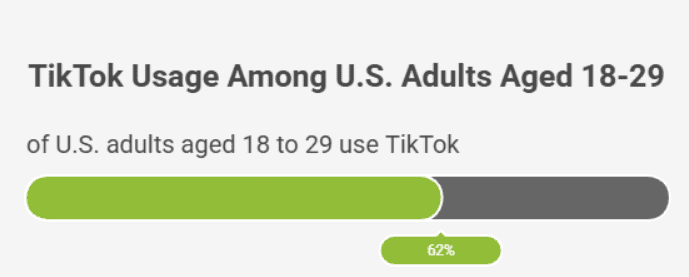

This shift is most visible among younger buyers since 62% of U.S. adults aged 18 to 29 use TikTok. For them, platforms like TikTok and Instagram are not side channels but central spaces where perceptions are shaped, trust is built, and leads are generated.

The real opportunity lies in collaborating with micro-influencers and creating authentic campaigns that resonate with younger, digitally savvy buyers. These partnerships offer more credibility than traditional ads and lower acquisition costs by engaging communities where purchase intent is already high.

The trend is already visible in practice. Mohawk Chevrolet in New York turned its TikTok into a mockumentary series styled like The Office. One episode garnered millions of views within days, increased dealership traffic, and even featured GM executives. This proves how authentic, lightly scripted content can drive real-world results.

@mohawkchevrolet Perhaps not. I'll take the 2026 Silverado instead! 😂 #MohawkChevrolet #Chevy #Chevrolet #Silverado #ViralVideo #FunnyVideo ♬ original sound - Mohawk Chevrolet

P.S. Wondering where to actually find authentic influencers who deliver sales? Platforms like inBeat Agency make this easier by giving you access to vetted creators and user-generated content at scale.

They focus on automotive influencer marketing that mixes paid ads with creator content. This way, brands get real leads and sales instead of just online buzz.

Search is undergoing its biggest shift in years, and the consequences for your visibility are real. Zero-click searches are reshaping how prospects find you.

In 2019, about half of all searches ended without a click. By 2024, that figure jumped above 75% on mobile, and projections suggest zero-click searches could exceed 70% overall by 2025. This means fewer visits to your dealer website and less control over how buyers experience your brand.

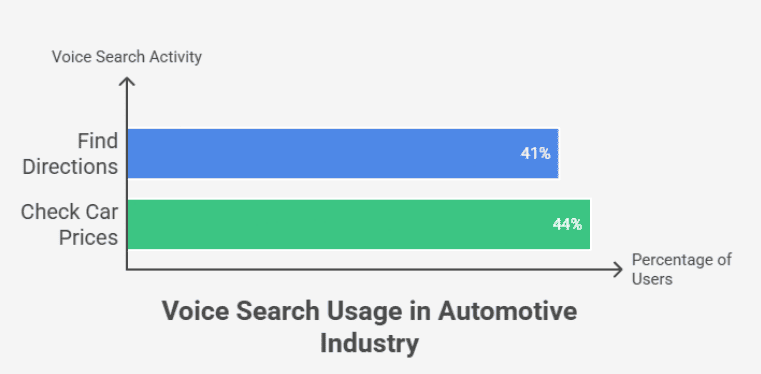

Voice search compounds the change. Studies show 41% of drivers now use it to find directions to dealerships, and 44% use it to check car prices.

Searches for “car dealerships near me” have surged more than 200% year over year. This growth is creating new traffic flows in local markets. If your content is not optimized for conversational and location-based queries, those buyers will land with competitors instead.

AI-generated summaries raise another challenge. One industrial manufacturer saw a 2,300% lift in traffic by tailoring content for Google’s AI Overviews. This shows how tailoring to AI-driven summaries can redirect demand at scale. To adapt, you need digital tools and strategies that anticipate AI reshaping and voice-driven intent.

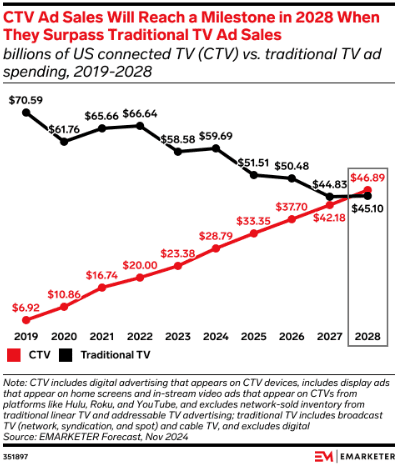

Cord-cutting has made connected TV (CTV) a core channel for automotive advertisers. Unlike traditional TV, CTV gives you targeting precision, real-time feedback, and direct attribution. This shift is already reflected in spending.

eMarketer projects CTV ad spend will reach $46.89 billion by 2028. This growth is being fueled by brands moving budgets away from linear television into channels where results are more transparent and measurable.

The real advantage lies in CTV’s ability to combine reach with measurement capabilities. Platforms now let you run dynamic creative, retarget engaged viewers, and connect national campaigns to dealership-level outcomes.

For example, you can serve a brand ad during a national broadcast. You can then follow up with localized offers tied directly to showroom visits or online configurator activity.

Real auto dealerships are already using Amazon DSP with attribution tools to measure impact. In one case, 26% of site traffic came from streaming ads, and exposed users were 5X more likely to convert.

Looking for a way to turn streaming exposure into real dealership results? Fieldtrip can help you take this further. Its CTV services let you connect national branding with dealership-level outcomes, so awareness efforts translate directly into leads and vehicle sales.

Personalization has moved from a nice-to-have to a performance driver. Research shows that tailored campaigns can deliver five to eight times higher ROI, which is why leading automakers are prioritizing data-driven approaches.

The truth is, broad messaging no longer works when buyers expect communication that reflects their needs, lifestyle, and stage in the journey.

Your advantage lies in using first-party data from dealership visits, purchase intent signals, and service history. This information helps you segment by demographics and design campaigns that feel relevant.

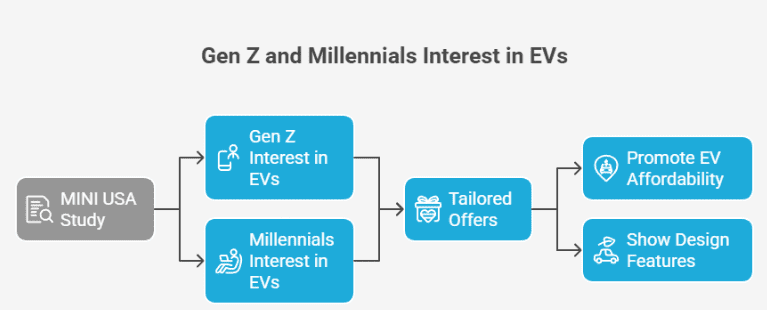

A MINI USA study, for example, showed Gen Z’s interest in EVs reached 72%, which is slightly higher than Millennials at 70%. Acting on these differences allows you to create precise offers, whether promoting EV affordability to one segment or showing design features to another.

The consequence of getting this wrong is wasted spend and eroded trust. But if done right, personalization reinforces trade-offs, increases customer lifetime value, and lowers acquisition costs.

Electric vehicles are growing, but the momentum is slowing. U.S. sales reached about 1.6 million units in 2024. This represents more than 10% of new automotive retail market sales.

At the same time, buyer intent is declining. As we've already mentioned earlier, only a small number of consumers planning to purchase a new vehicle in the next two years are considering an EV, down from nearly half just a year earlier.

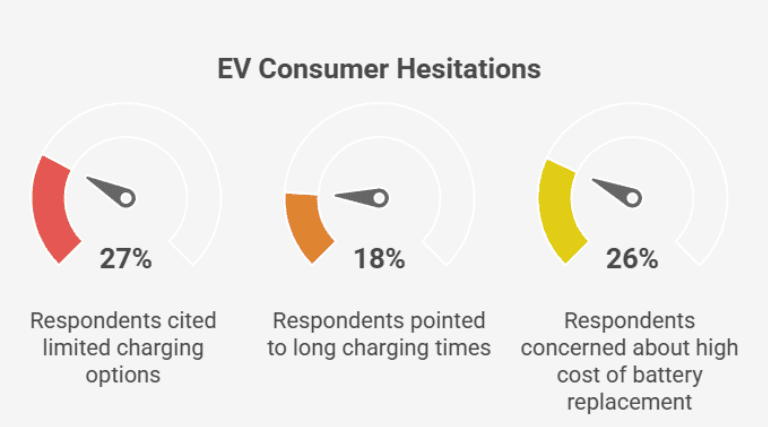

Concerns about infrastructure and cost continue to hold prospects back. According to EY Global, 27% of respondents cited limited charging options as their main hesitation, while 18% pointed to long charging times. Another 26% said they are concerned about the high cost of battery replacement.

These concerns reveal a clear shift in priorities. Buyers are focusing less on eco claims and more on practical factors such as affordability, safety, and convenience. This means your EV campaigns must go beyond sustainability slogans.

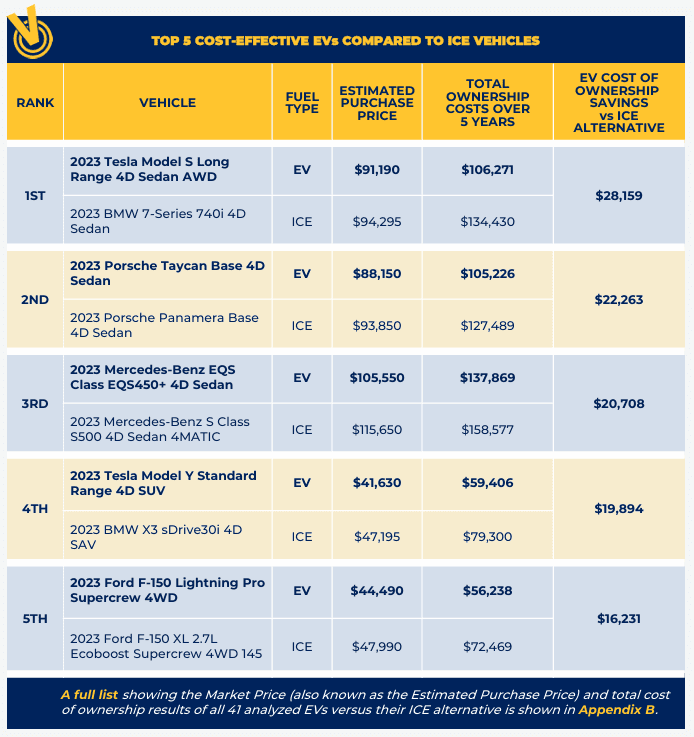

You'll need to show the total cost of ownership, available incentives, and clear charging options. Many automakers already do this by using Vincentric’s TCO analysis. It compares EV and ICE costs across purchase price, fuel, maintenance, and more to make the value case clear.

Here’s a glimpse of that:

Transparency builds trust and supports customer retention, especially when the buying decision stretches across months of research. To remain credible, your messaging should combine environmental responsibility with clear financial and practical benefits.

Video has become the centerpiece of how buyers research and engage with vehicles. Digital video now makes up more than 80% of all internet traffic in 2025. Interestingly, users watch an average of 17 hours of online video every week.

For automotive, the impact is even more direct. Data shows that shoppers who view video content are 1.81 times more likely to complete a purchase. Also, YouTube remains the primary channel for research, with 92% of auto buyers using it for reviews and comparisons.

This makes the format of your video just as important as the platform itself. When you test the right creative approach, the results can be dramatic.

Case studies show how effective the right format can be. Renault Australia cut cost per acquisition by 51% using motion ads and retargeting strategies that drove traffic to dealer actions such as brochures, test drives, and online configurations. Here’s one of their motion ads:

Motion ads, short videos, and live streaming all show strong results when used across the funnel. Your next step is to connect these formats across channels.

Use TikTok for awareness, YouTube influencer marketing for reviews, and tools such as virtual car configurators to support decision-making. This way, video guides buyers from the first impression to purchase.

Hyundai has already done this with their IONIQ 5 campaign by repurposing TV ads for TikTok and getting creators like @angryreactions to “react” with Duet videos. This blended polished content with authentic voices and pushed viewers closer to engagement.

Here’s an example:

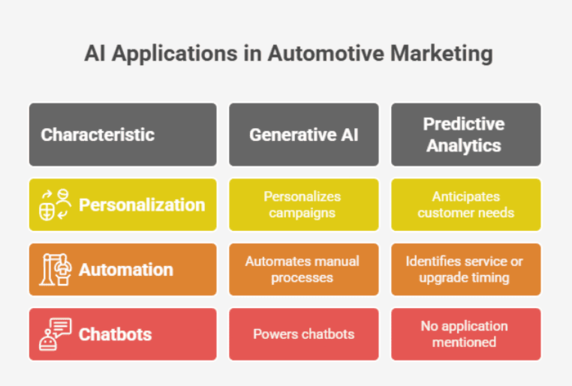

AI is moving from experimentation to practical application in automotive marketing. With generative AI, you can personalize campaigns, power chatbots, and automate processes that once required manual effort. With generative AI consultants, you can personalize campaigns, power chatbots, and automate processes that once required manual effort.

Predictive analytics takes this further by anticipating customer needs. It can show when a buyer will be ready for service or when they’re likely to consider an upgrade.

Automakers are already testing AI at scale. Mercedes-Benz has integrated ChatGPT into its MBUX voice assistant through Azure’s OpenAI Service. A U.S. beta program launched across more than 900,000 vehicles in 2023 and made in-car voice control more conversational.

“The integration of ChatGPT with Microsoft in our controlled cloud environment is a milestone on our way to making our cars the centre of our customers’ digital lives. Our beta programme boosts the existing Hey Mercedes functions, such as navigation queries, weather requests, and others, with the capabilities of ChatGPT. This way, we aim to support conversations with natural dialogues and follow-up questions. Our customers can always rely on us to ensure the best possible protection of their data privacy. Everything is under one big goal: Redefining the relationship with your Mercedes.” - Markus Schäfer, Member of the Board of Management of Mercedes-Benz

Stellantis also introduced an AI assistant using ChatGPT for brands like Peugeot, DS, and Opel. This earned the company the SMARTBEST 2025 award for advanced onboard technology.

It also showed Stellantis’ lead in creating natural, fluid voice interactions. These examples point out how quickly AI is reshaping both customer interaction and brand experience.

For you, the key is to test AI tools in your marketing stack while keeping your brand voice consistent. But keep in mind that automated chat responses or AI-generated campaigns should support authenticity instead of replacing it.

When you link predictive analytics with personalization, you gain the scale to improve efficiency. This also helps you prove ROI in ways that boards and investors will value.

Local visibility has become an important driver of dealership traffic. Research from SOCi shows that 80% of U.S. consumers now search for local businesses weekly, with 32% doing so daily.

When these searches happen on smartphones, intent quickly translates into action because 76% of people who run a “near me” search visit a business within a day, according to Think with Google. For auto marketers, this means local relevance directly affects showroom visits and test drive volume.

The challenge is that search engines increasingly prioritize hyperlocal results. A strong Google Business Profile, consistent local listings, and location-specific ad campaigns are no longer optional. They determine whether your dealership appears in front of nearby buyers at the moment of intent. For example, Schaller Honda improved its Google Business Profile and local SEO, which led to higher rankings and a 38% lift in engaged sessions within just a few months.

You can take this further with Location Performance Optimization (LPO). If you analyze performance across multiple rooftops, you can identify where your campaigns drive foot traffic most effectively and redirect spend accordingly.

This allows you to balance national branding with local conversion impact. It also helps you create measurable links between digital activity and vehicle sales.

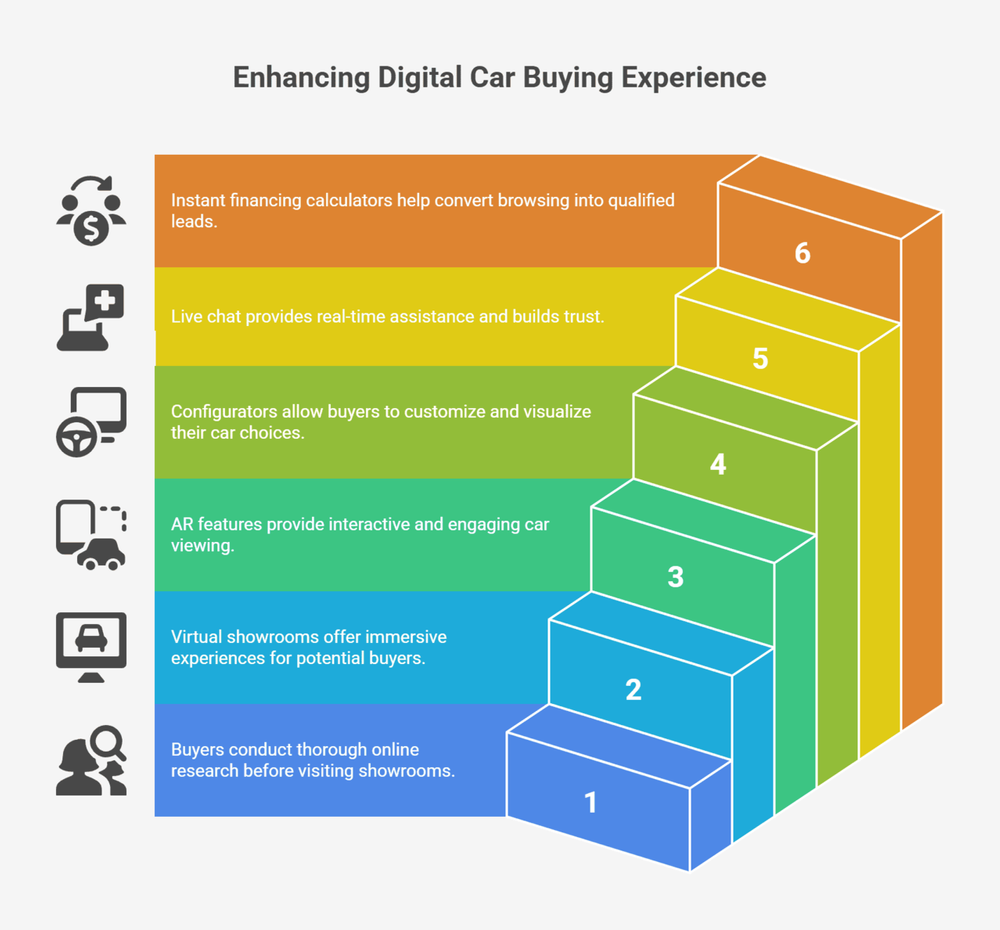

The car-buying journey has moved online and has changed how buyers interact with your brand. Today, 90% of buyers do detailed research before they ever step into a showroom. Many are confident enough in digital channels that 14% now complete purchases without taking a single test drive. This shows that the first impression is typically shaped long before a face-to-face conversation happens.

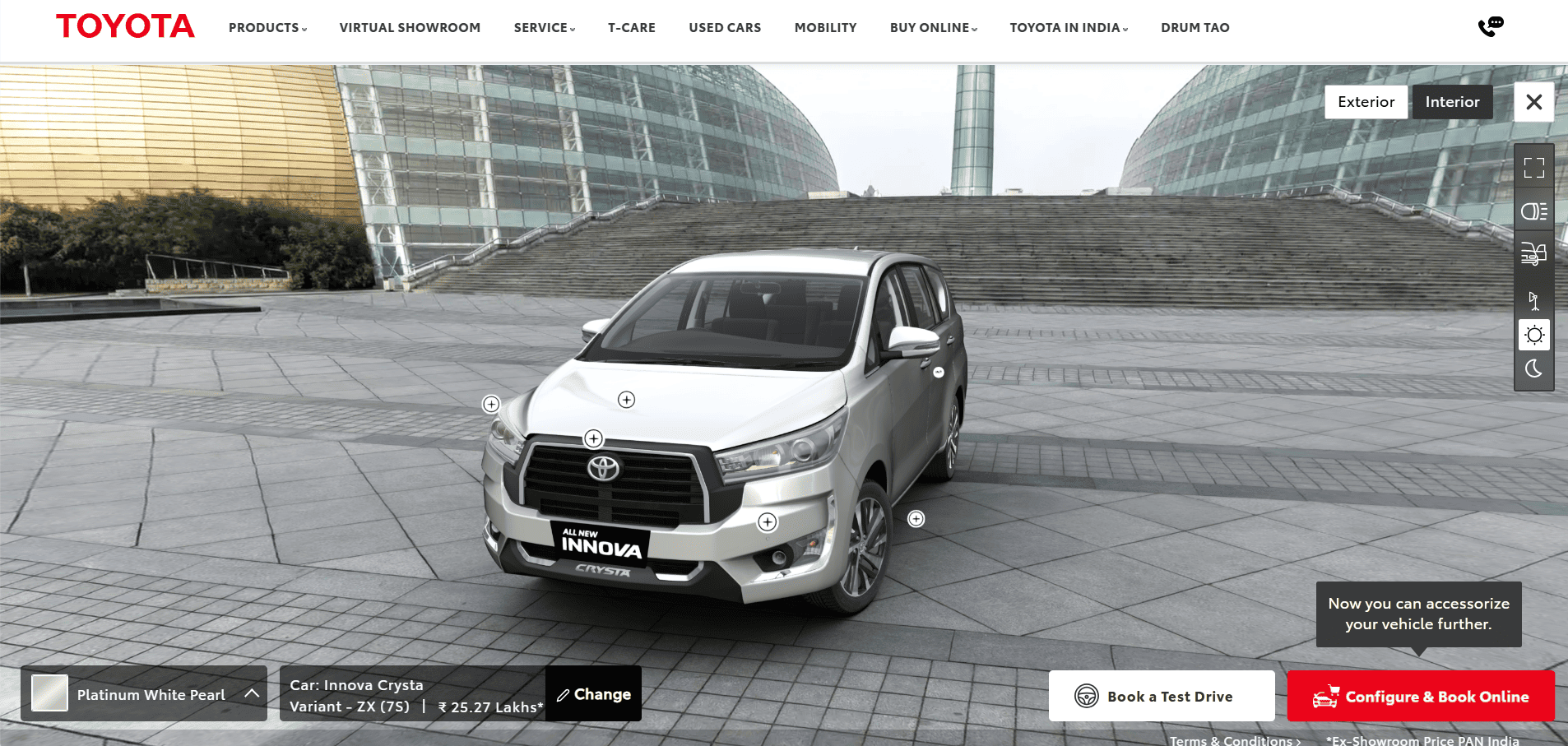

To meet these expectations, you need to provide digital tools that build trust and reduce friction. Virtual showrooms, augmented reality features, and online configurators give buyers confidence in their choices.

Many brands are already doing this. For example, Toyota offers a virtual showroom where buyers can explore interiors and exteriors online. It even uses AR to see how a car looks in their own driveway.

Adding live chat and instant financing calculators helps turn browsing into qualified leads by giving customers real-time answers. Toyota has also added this feature to its showroom.

The challenge is connecting these digital touchpoints into one seamless experience. Lead capture should not feel disconnected from research tools.

Dealership interactions should align with what buyers have already explored online. When you design a journey that mirrors how people actually shop, you improve conversion rates and reduce acquisition costs.

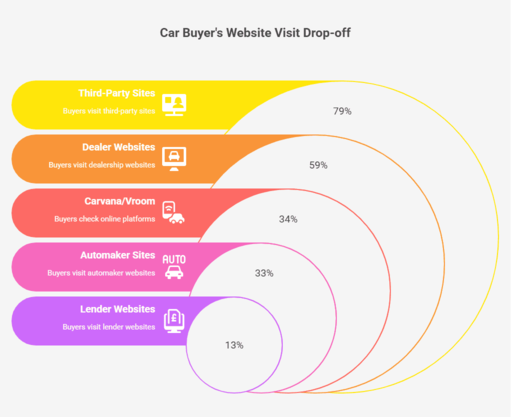

Car shopping no longer follows a simple path from research to purchase. Buyers now move fluidly between channels. They compare information from third parties, dealerships, automakers, and even lenders.

Cox Automotive reports that the average shopper now visits nearly five different websites in the process, up from four just a few years ago.

The distribution of attention tells an important story. Third-party sites such as Kelley Blue Book or Autotrader are visited by 79% of buyers. This makes them the most influential stop in the process. Dealership websites follow at 59%, while 34% of buyers check platforms such as Carvana or Vroom.

Automaker sites attract 33%, while lender websites, once overlooked, have surged, now drawing 13% of shoppers, an 86% increase since 2021. This fragmentation shows that buyers are not loyal to a single channel. Instead, they validate information across platforms before taking the next step.

The consequence is clear.

Messaging and offers must stay consistent regardless of where buyers engage. A promotion seen on a dealer website should align with what appears on third-party listings or automaker platforms.

Attribution models should reflect the omnichannel buyer’s journey by showing how interest built in one channel contributes to a conversion in another. Without that connection, you risk wasting spend and missed ROI.

Automotive marketing is shaped by rapid shifts in buyer behavior, flat ad budgets, and new technologies. AI, zero-click search, and predictive analytics are changing how buyers research and make decisions.

At the same time, EV adoption is slowing, putting more focus on cost and safety instead of hype. To build trust, you need personalization, strong local performance, and consistent messaging across every channel.

At inBeat Agency, we combine analytics, influencer expertise, and ROI-driven execution to help auto brands turn strategy into measurable outcomes.

Reach out to us today to discuss how we can support your growth.

What are the current trends in the automotive industry?

Key trends include electrification, autonomous driving, connected cars, and software-defined vehicles. You also see a push toward sustainability and Mobility-as-a-Service models, alongside rising use of AI and changes in customer expectations.

What are the challenges of the automotive industry in 2025?

You face flat margins, supply chain volatility, and slower-than-expected EV adoption due to cost and infrastructure gaps. The industry must also adapt to software-defined vehicles, rising competition, and consumer demand for tech-driven mobility.

What is the automotive market forecast for 2030?

Global vehicle sales are projected to reach about 104 million units by 2030. Growth will be fueled by EV adoption, advanced in-car features, and demand from emerging markets, while mature markets remain more stable.

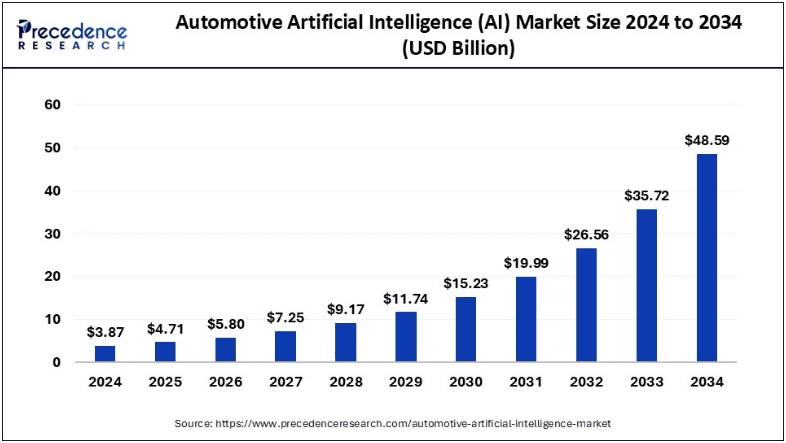

How will AI impact the auto industry?

AI is reshaping safety, autonomy, and customer experience. From predictive maintenance to voice assistants and personalized services, it improves efficiency across manufacturing, supply chains, and vehicle ownership.